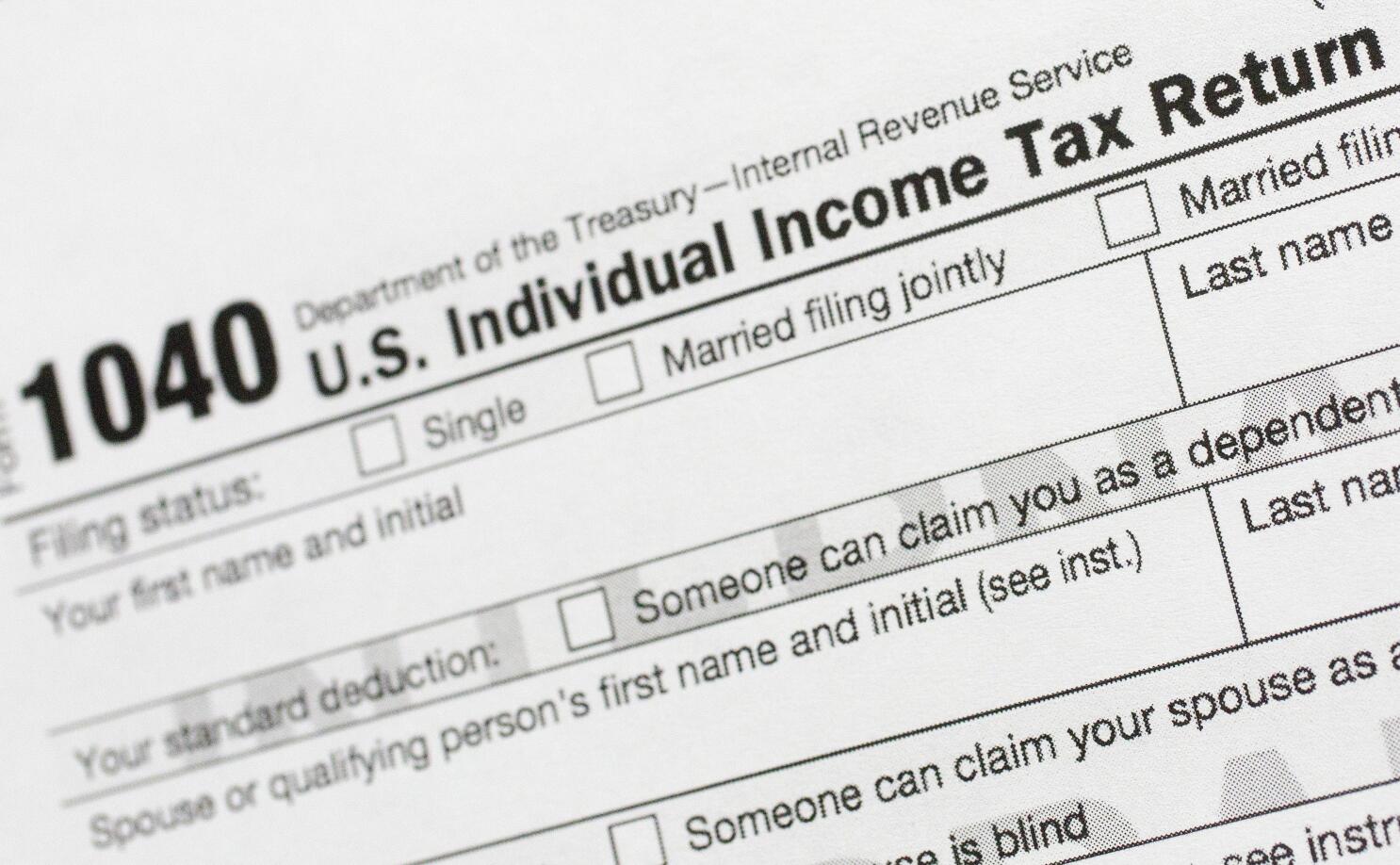

Claiming California's New $1,083 Foster Youth Tax Credit: A Tax

Por um escritor misterioso

Descrição

This guide is designed to help transition-age youth file their taxes and claim a cash back refund. The publication outlines information about tax laws, tax credits and deductions, tax filing requirements, documentation needed to file, and free tax preparation services.

Midway through California's Extended Tax Season, Low-Income Filers Are Claiming Larger State Credits - Public Policy Institute of California

CalEITC cash-back tax credit - CalEITC4Me

Foster Care Month

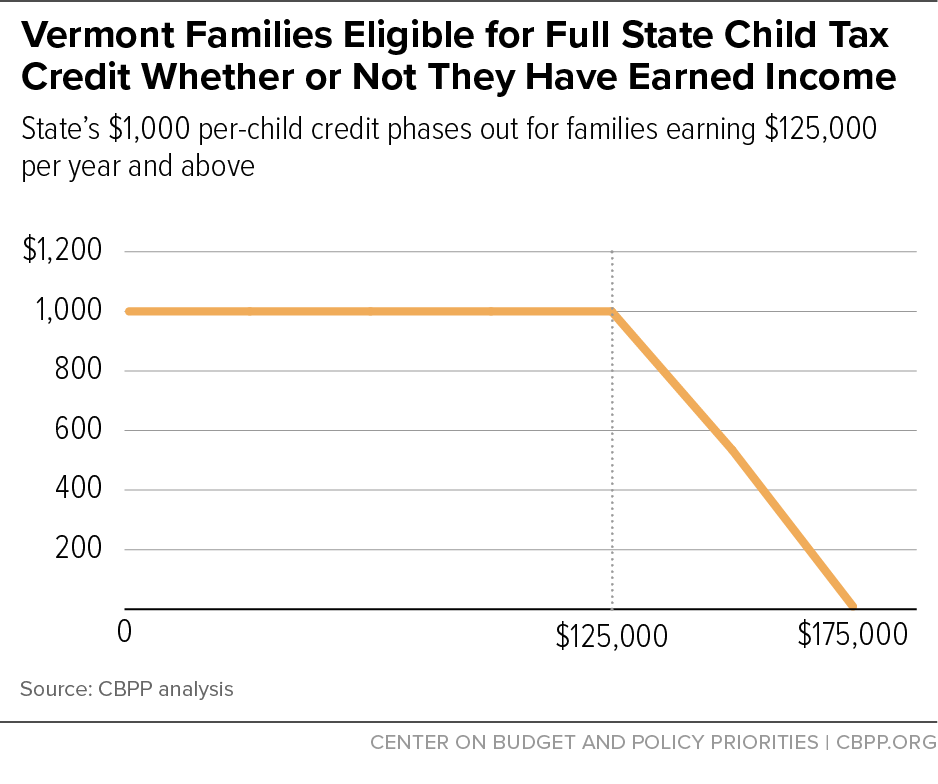

States Can Enact or Expand Child Tax Credits and Earned Income Tax Credits to Build Equitable, Inclusive Communities and Economies

$1,083 reasons to file your taxes - California's New Foster Youth Tax Credit

Foster Youth Tax Credit

Many not claiming California tax credits for foster youth - Los Angeles Times

What is the difference between EITC and CalEITC? Can you claim both? - AS USA

States Can Enact or Expand Child Tax Credits and Earned Income Tax Credits to Build Equitable, Inclusive Communities and Economies

CalEITC cash-back tax credit - CalEITC4Me

Cash at the State Level: Guaranteed Income Through the Child Tax Credit - Jain Family Institute

de

por adulto (o preço varia de acordo com o tamanho do grupo)