Withholding FICA Tax on Nonresident employees and Foreign Workers

Por um escritor misterioso

Descrição

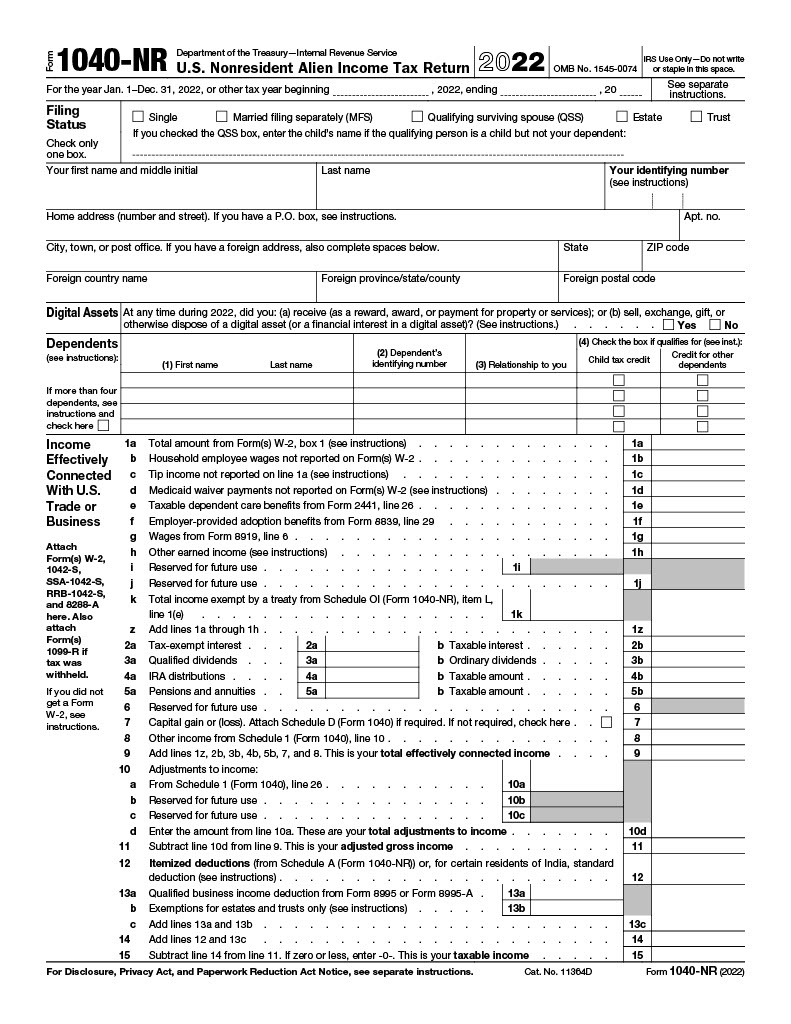

The proper determination of FICA tax exemption for nonresident employees has become particularly tricky for payroll staff in organizations across the US. In this guide, we share some tips for effective management of nonresident payroll.

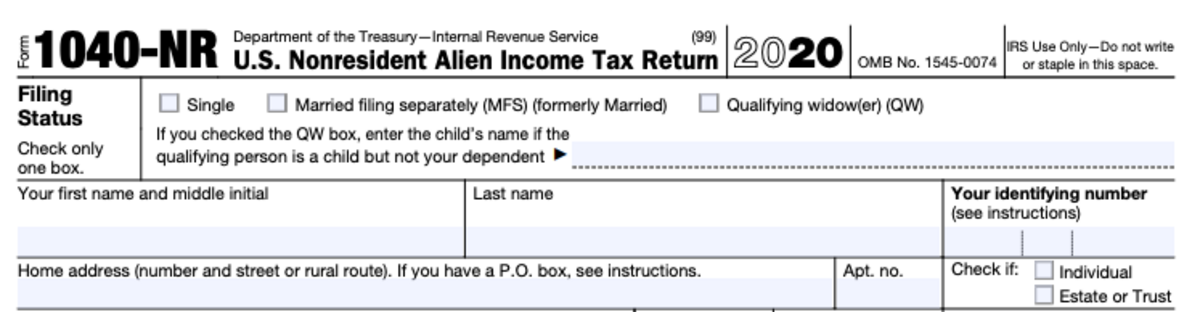

Which Employees Are Exempt From Tax Withholding? - Payroll

Employment & Taxes Office of International Students & Scholars

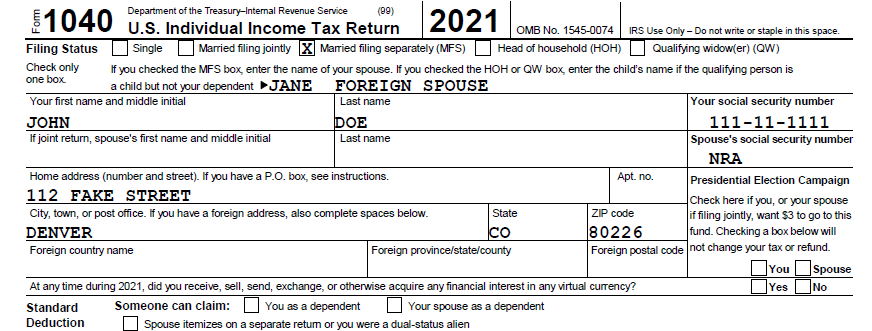

Do You Need an ITIN for Your Non-Resident Alien/Foreign Spouse If

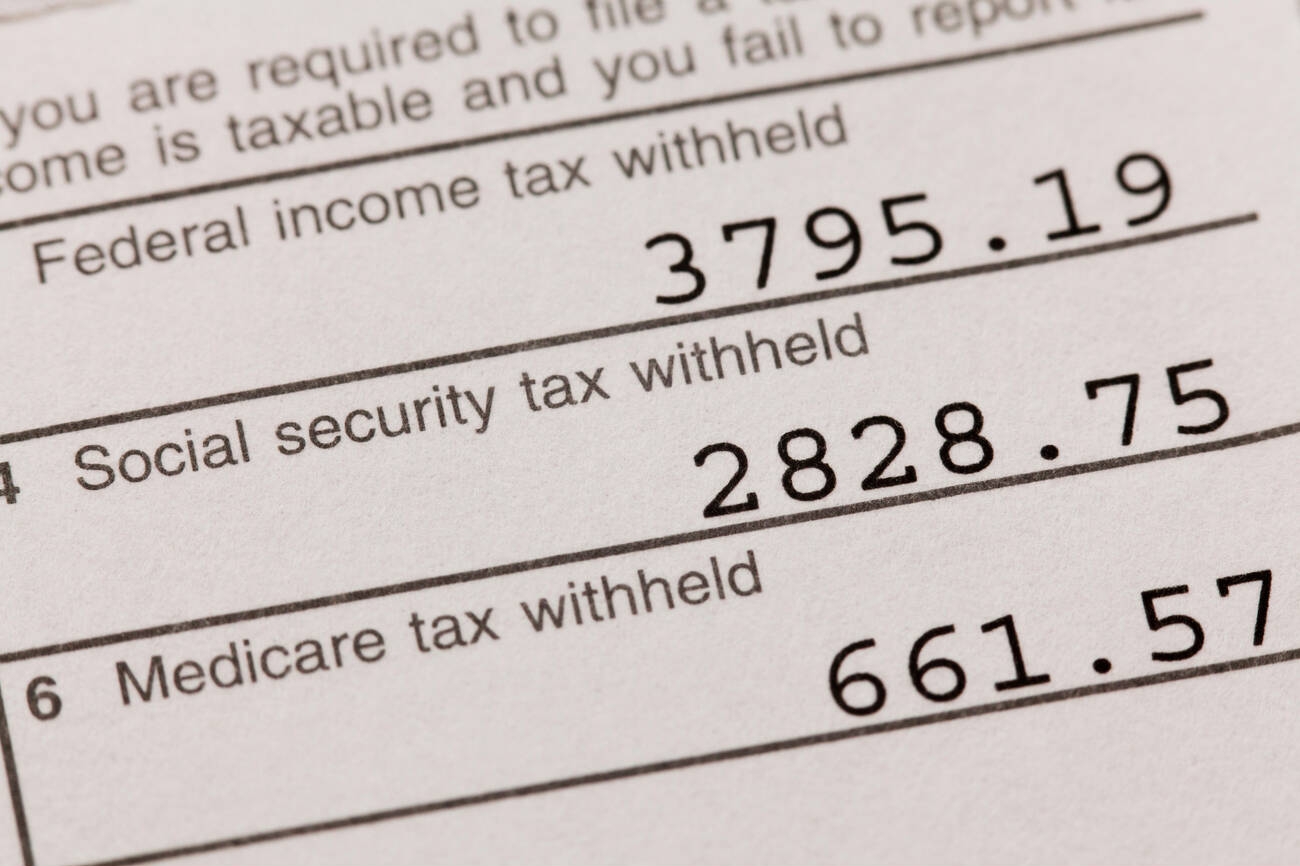

Social Security Tax Wage Base is Going Up 5.2% for 2024 - CPA

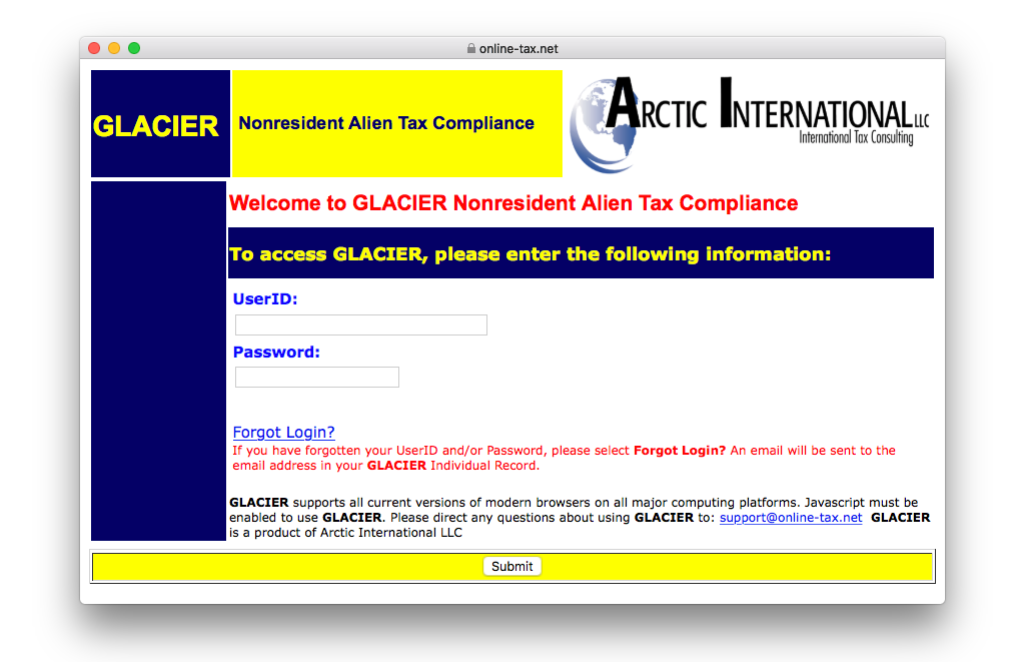

Glacier Nonresident Alien Tax Compliance System - Payroll

Payroll Services - Non-Resident Alien

The Complete J1 Student Guide to Tax in the US

Nonresident Aliens and Social Security - GW Carter Ltd

Publication 915 (2022), Social Security and Equivalent Railroad

Income Taxes and FICA Withholding Exemption(s) for Foreign Workers

de

por adulto (o preço varia de acordo com o tamanho do grupo)