Tie Breaker Rule in Tax Treaties

Por um escritor misterioso

Descrição

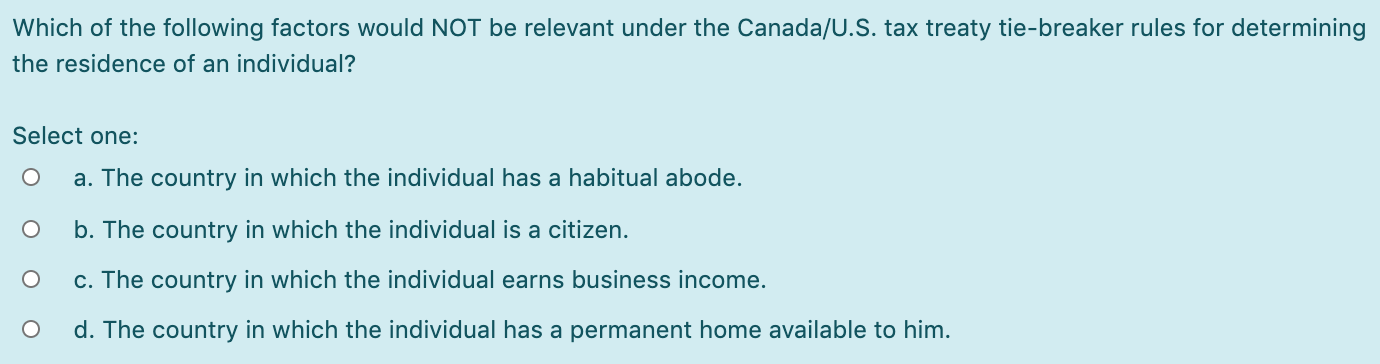

Hello Connections, Let’s briefly discuss the Tie Breaker Rule in Tax Treaties. Tie Breaker Rule are used when an individual becomes resident in both contracting states due to their domestic laws/rules, to determine the residential status of such individual for the purpose of taxability of income.

Solved Which of the following factors would NOT be relevant

Residency Tie Breaker Rules & Relevance

U.S. Australia Tax Treaty (Guidelines)

Treaty Tiebreaker Rule vs Closer Connection: Tax Avoidance Rules

Tax treaty: Demystifying Tax Treaties: How They Affect Expatriation Tax - FasterCapital

Tax Laws for U.S. Green Card Holders

Chapter 8 Are Tax Treaties Worth It for Developing Economies? in: Corporate Income Taxes under Pressure

Chapter 8 Are Tax Treaties Worth It for Developing Economies? in: Corporate Income Taxes under Pressure

Residency test under taxation treaty

US-NZ Income Tax Treaty Professional Income Tax Law Advice

Tax residency in Canada - overview

India - The Dilemma Of Dual Residence – Can Vital Interests Fluctuate Overnight? - Conventus Law

How US citizens and Green Card holders living in India can file tax - The Economic Times

Keyword:individuals tax residency - FasterCapital

Dual residence and tax treaties' tie-breaker rules: Can a temporary accommodation amount to habitual abode?

de

por adulto (o preço varia de acordo com o tamanho do grupo)